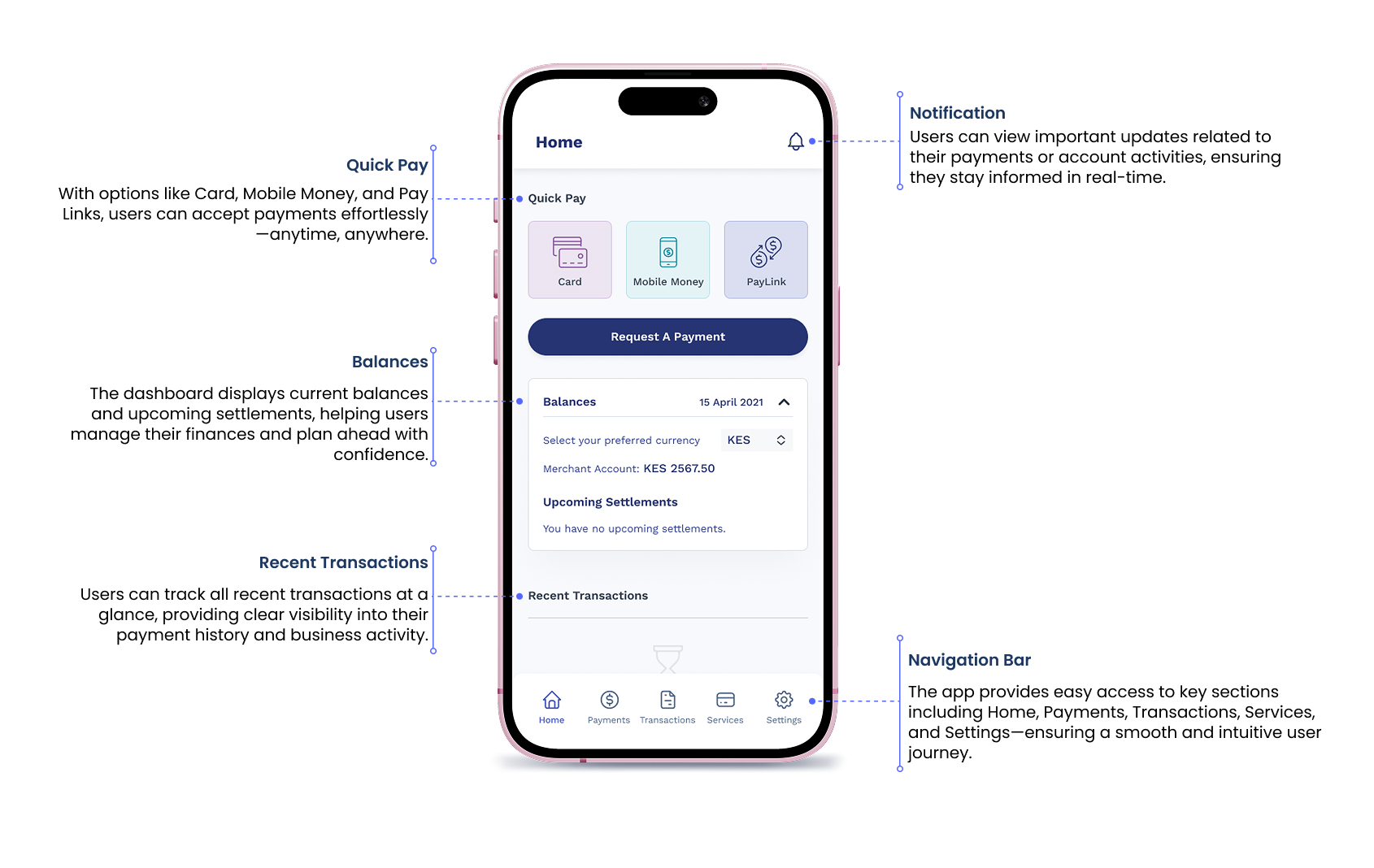

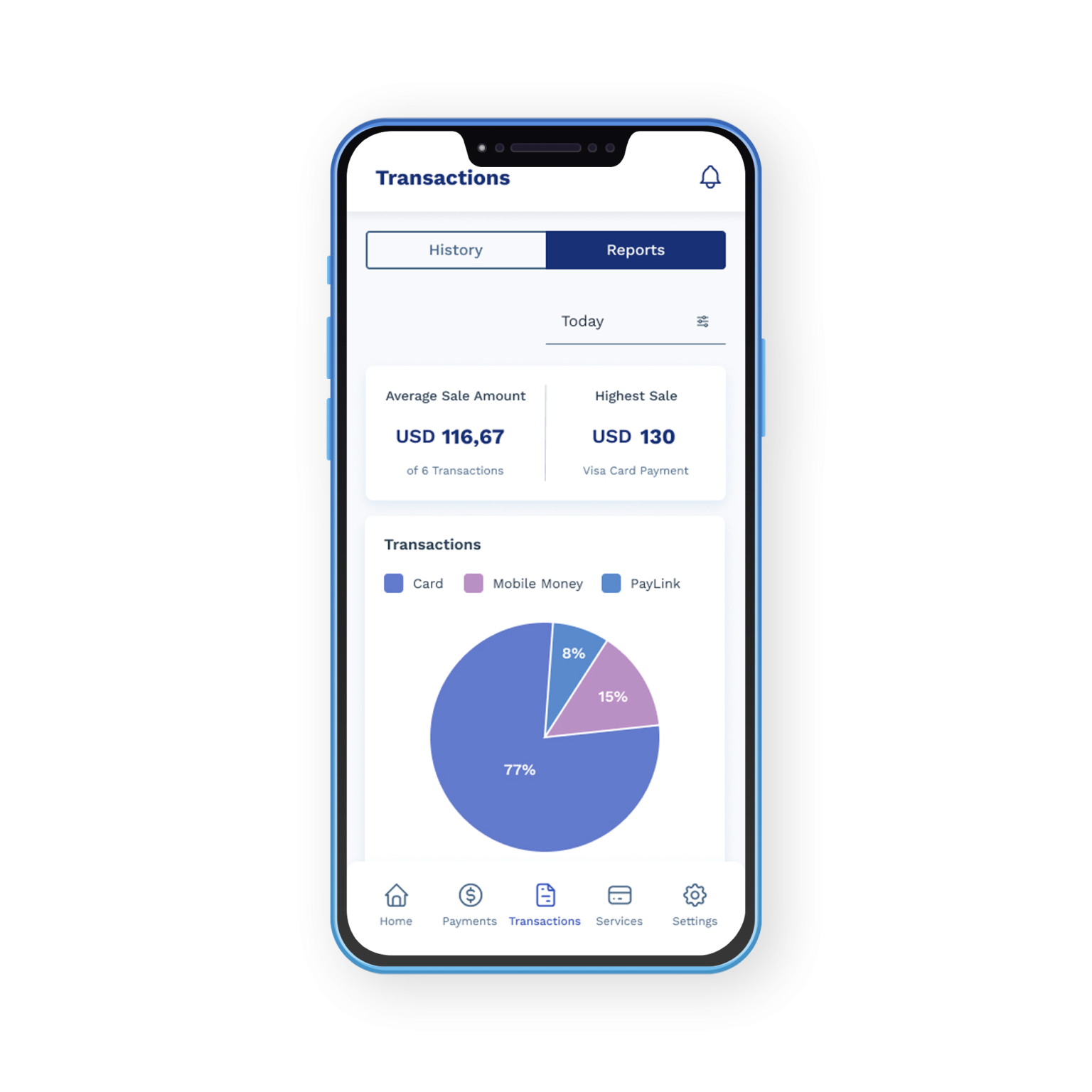

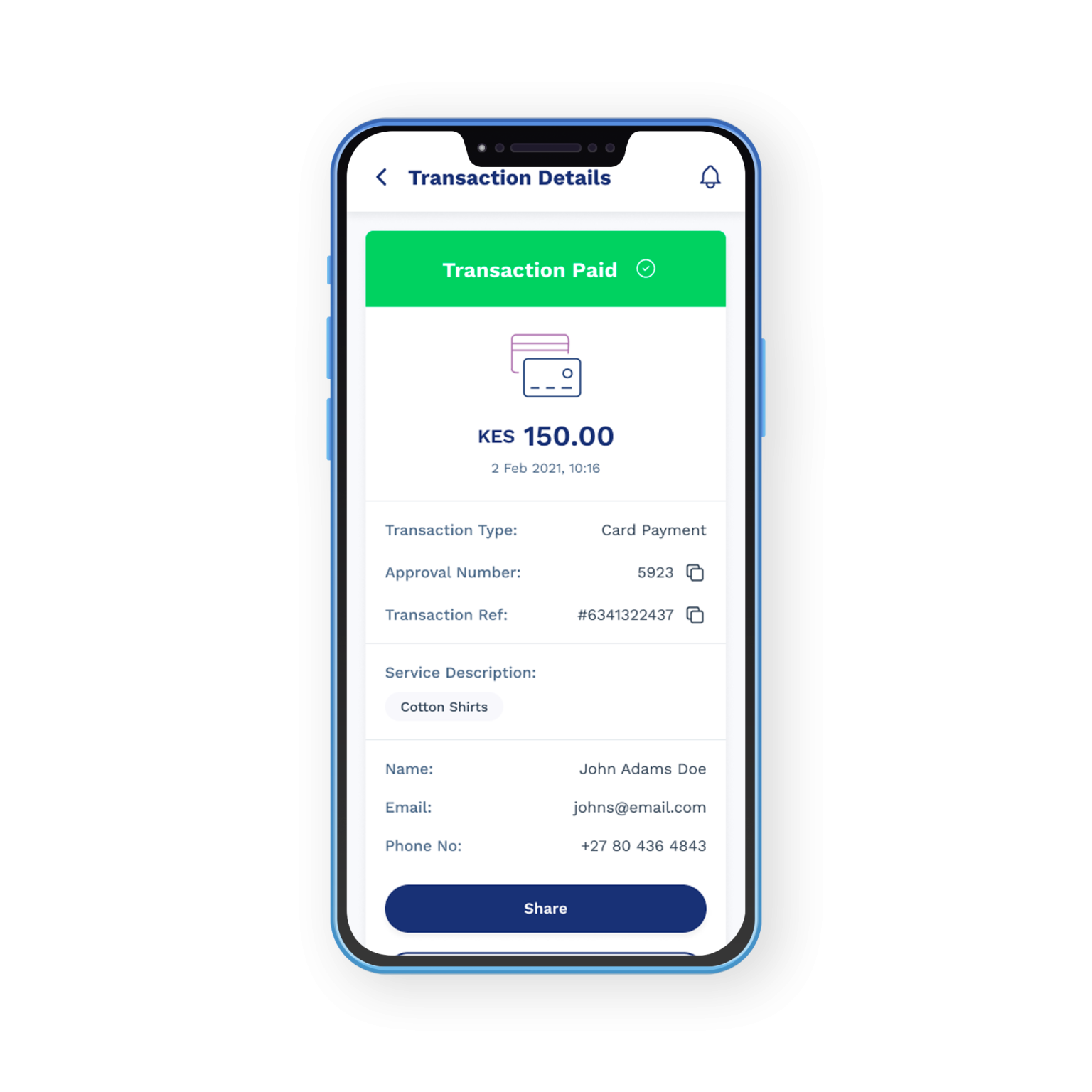

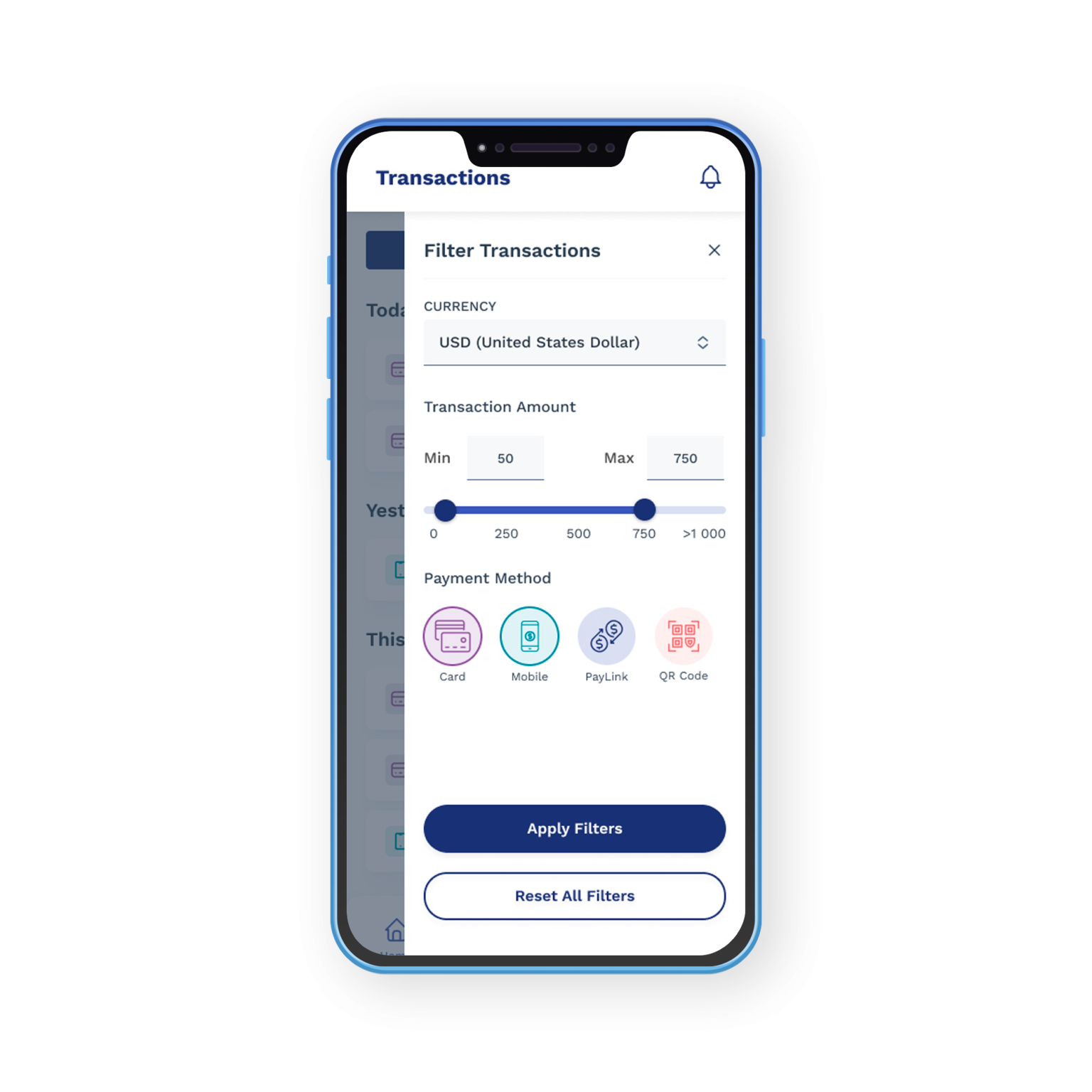

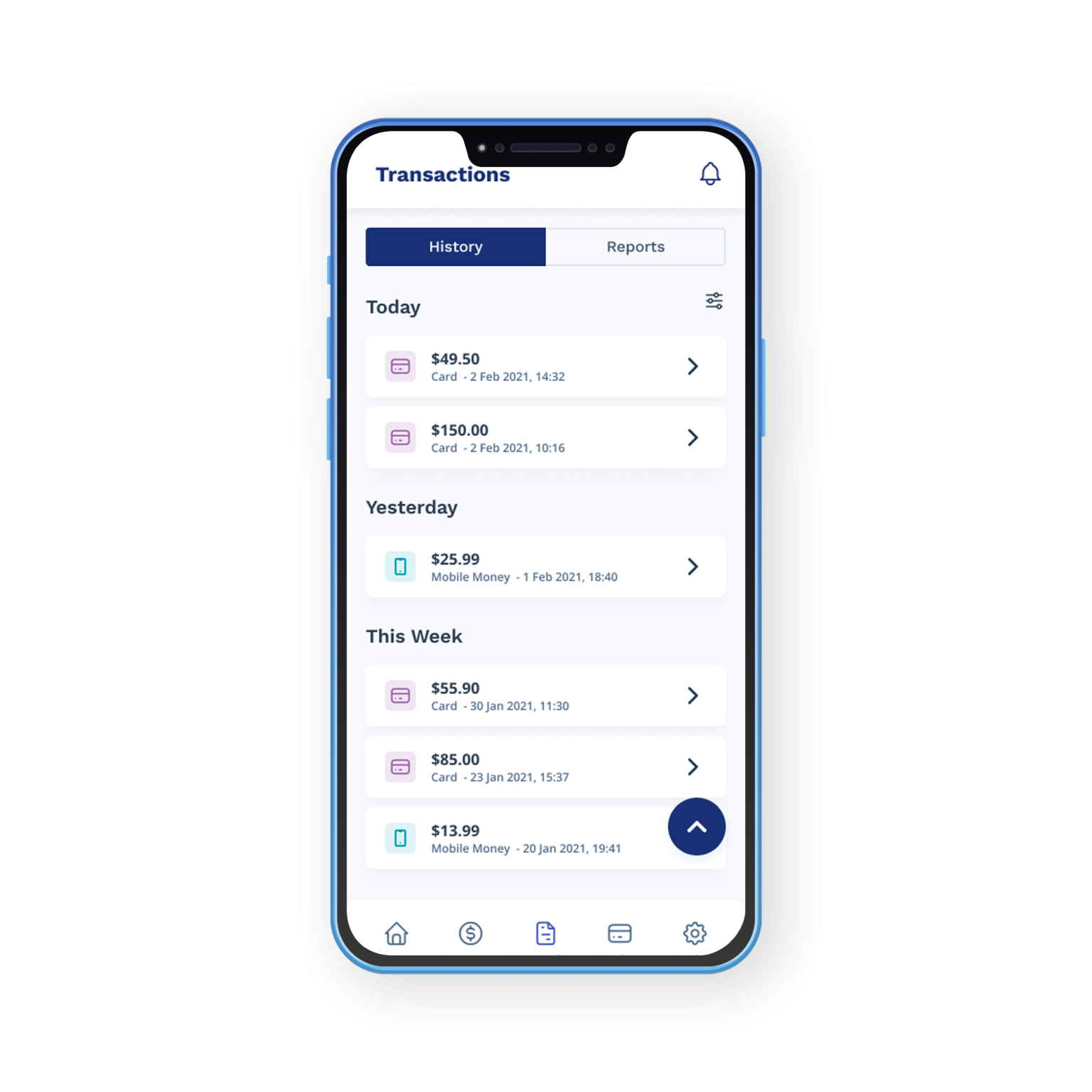

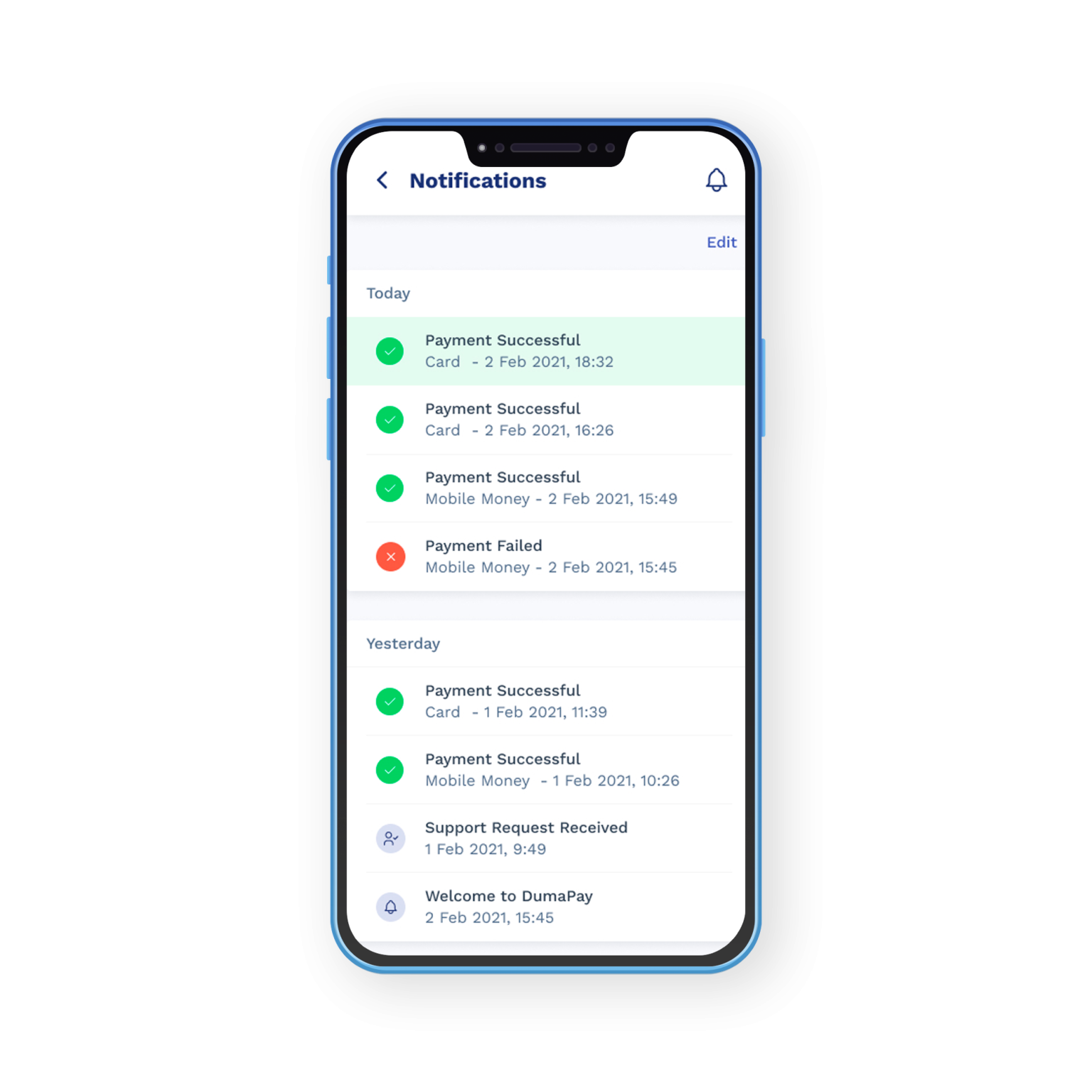

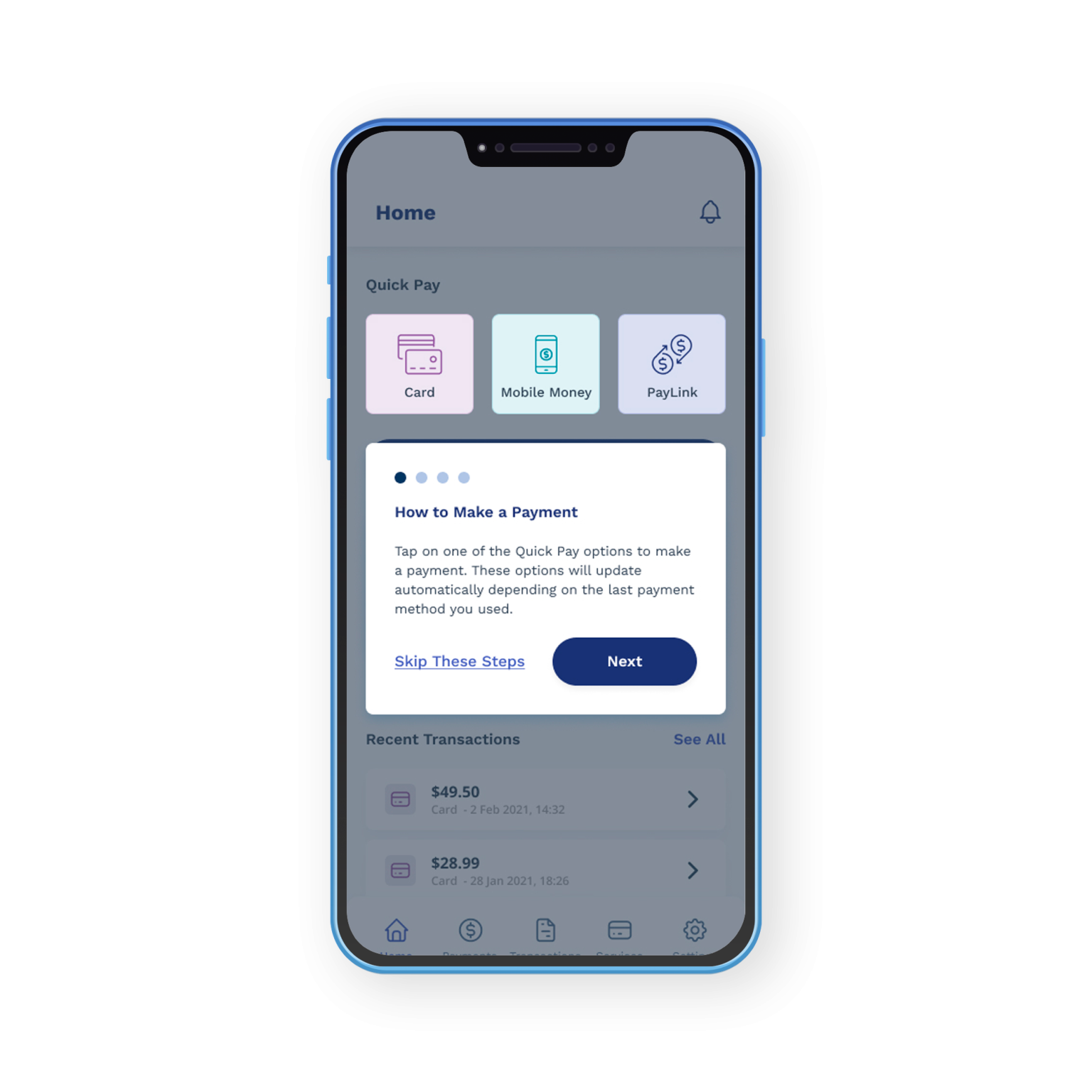

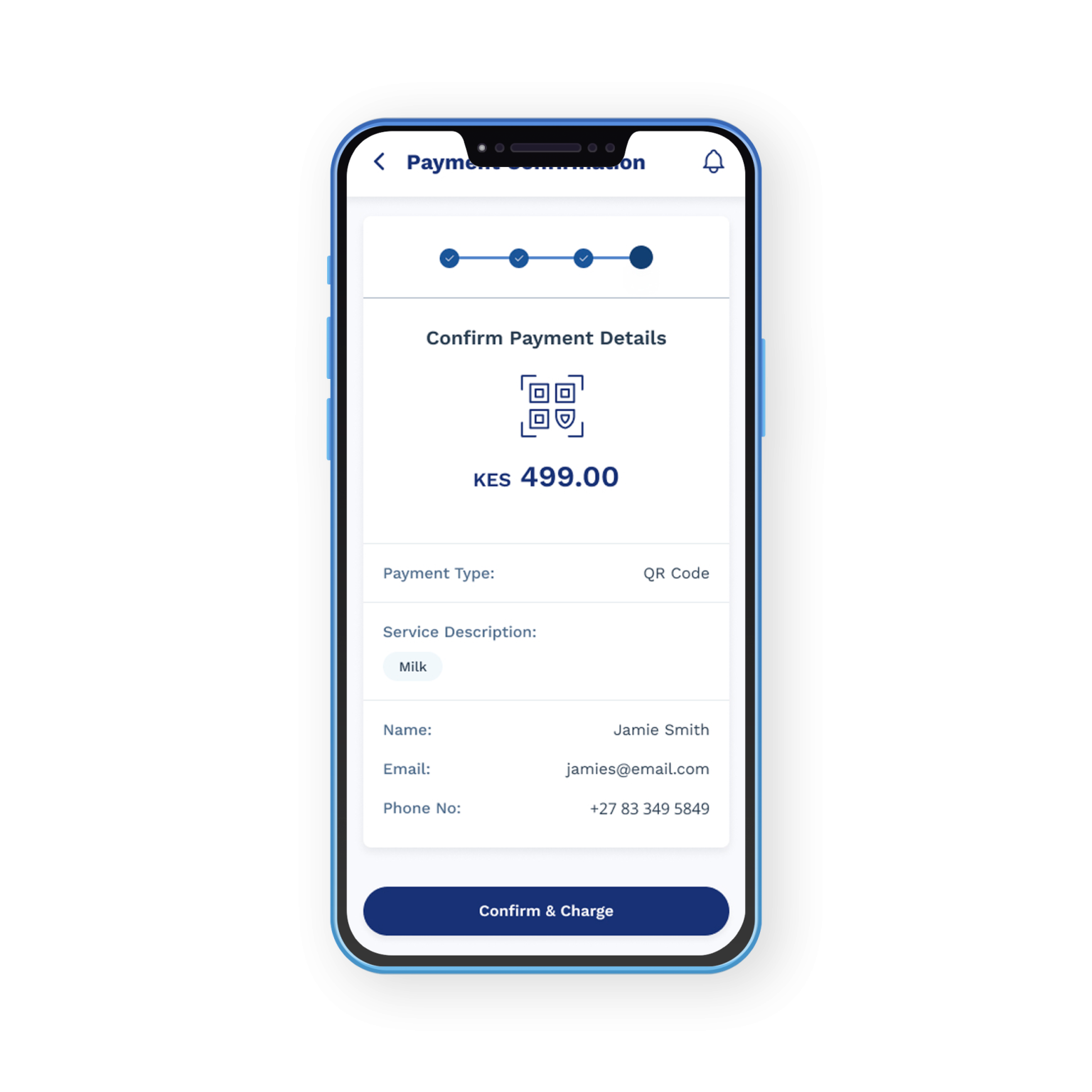

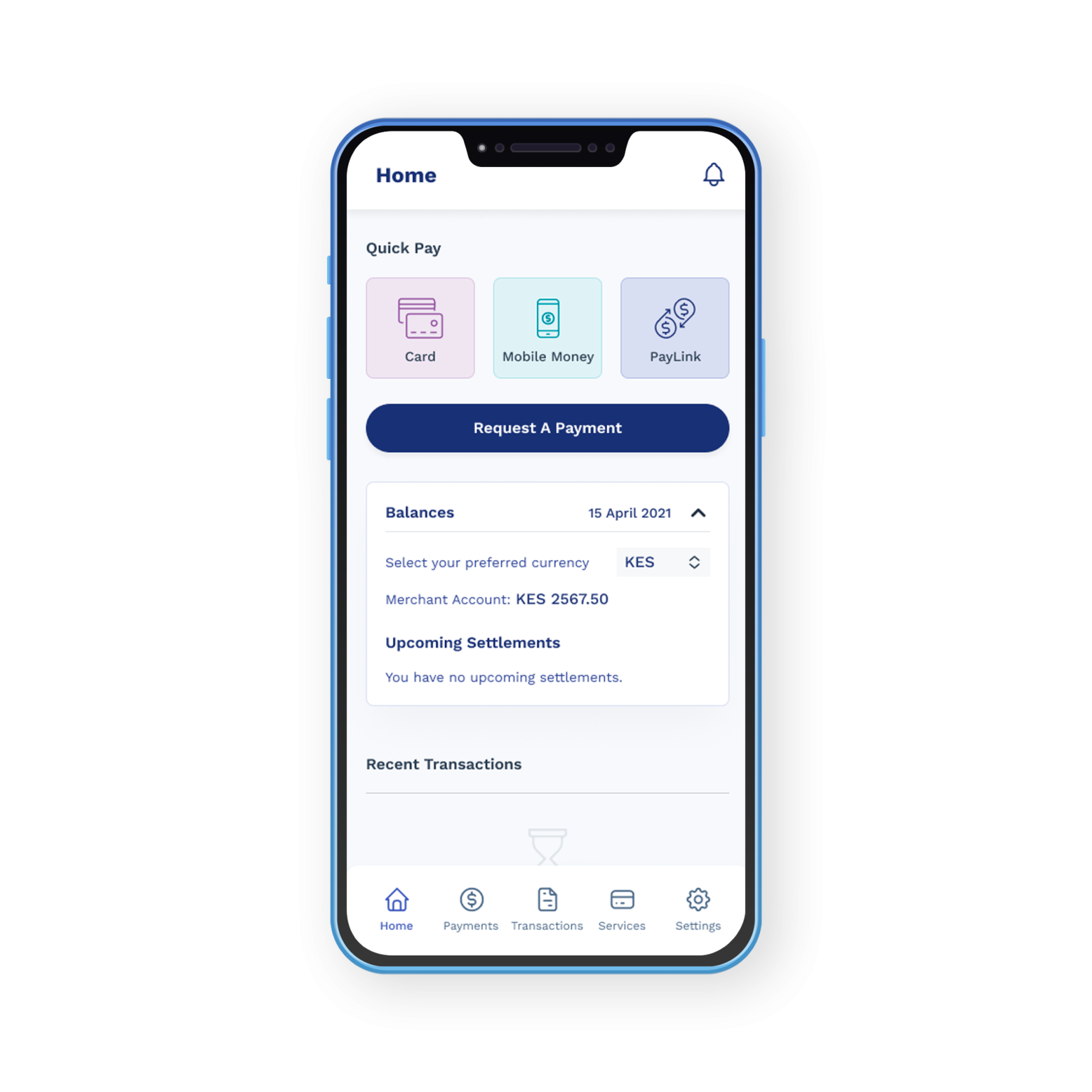

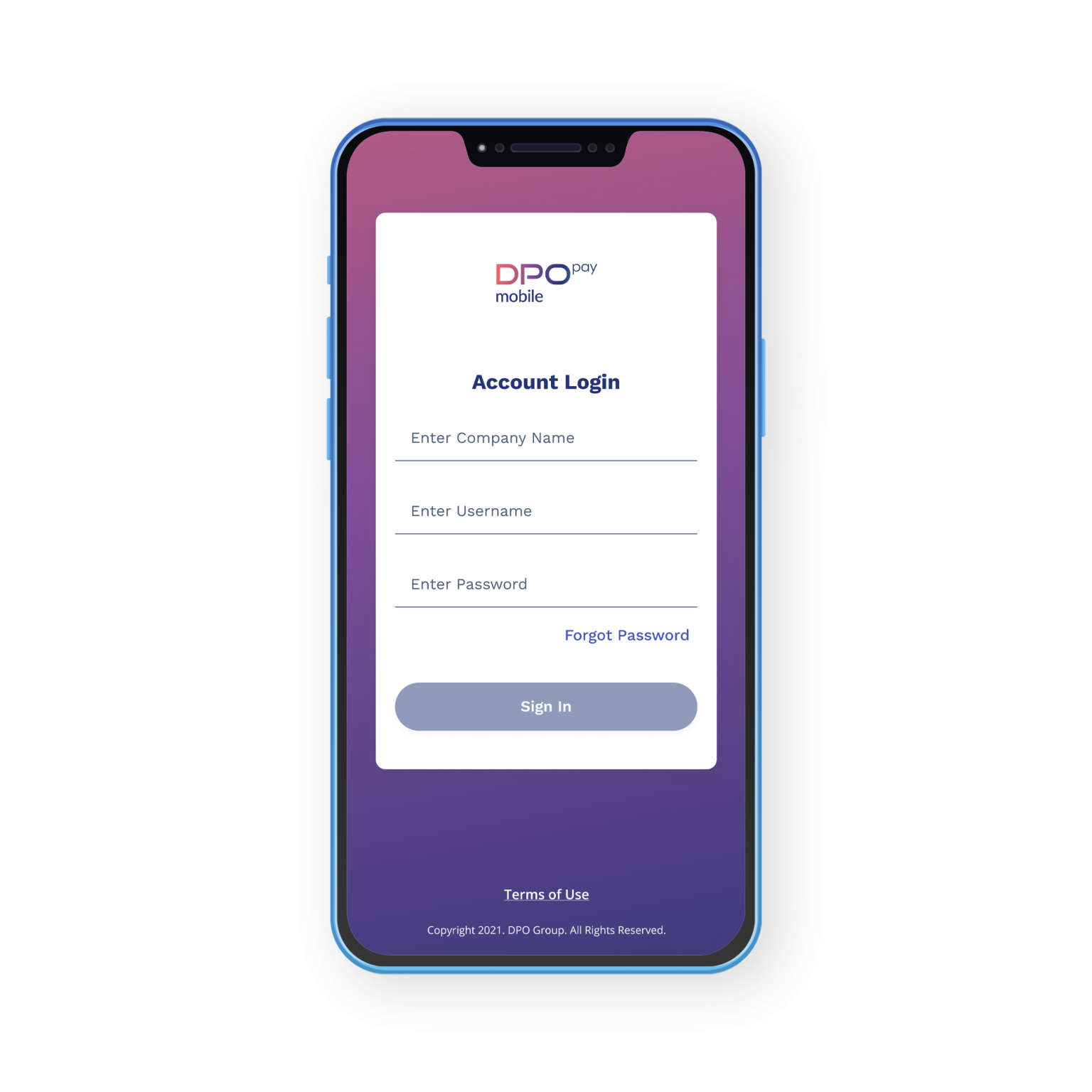

The DPO Pay App is designed around real merchant needs—intuitive, flexible, and reliable. Its clean interface and seamless experience make it easy for businesses across Africa to accept payments, track transactions in real time, and operate with confidence anytime, anywhere.